The window of opportunity is still open for maturity funds

Building on the success of Sycoyield 2026, its first fixed-term strategy launched in September 2022 and now totalling 430 million euros under management*, Sycomore Asset Management has created a second maturity fund: Sycoyield 2030.

Sycoyield 2030 aims to crystallise today’s attractive yields over a longer period than its first fixed-term strategy, before central banks reverse course on their monetary policy. This policy pivot, likely to occur within the new few quarters,should indeed lead to a lower rate environment.

The investment strategy shares many common characteristics with Sycoyield 2026. The fund invests mainly in high-yielding corporate bonds issued in euros (including convertible and hybrid bonds – or subordinated), targeting credit ratings essentially within the BBB and BB categories**. In addition to emphasising risk management, the selection of issuers will consider environmental, social and governance factors. The fund is classified as article 8 under SFDR.

The portfolio is built following a thorough selection of bonds from diversified regions and sectors, mostly maturing in 2030. The objective of the investment team is to carry these bonds until their maturity, as long as the issuer’s risk profile remains attractive. The managers focus on resilient companies able to resist to a more hostile economic environmentaccording to their analysis.

The fund managers have a preference for moderately cyclical sectors, such as telecoms (Orange, T-Mobile Netherlands), utilities (Iberdrola, Veolia), and companies capable of adjusting their investments to the cycle (Boels, Verisure, Loxam).

They also position the portfolio on sectors driven by long-term and positive trends, such as infrastructure (Autostrade per l’Italia, Indigo). The team also appreciates issuers demonstrating high pricing power, including companies with recognised brands such as Birkenstock.

A new spread and yield environment

In these first months of 2024, our view is that the risk/return ratio remains favourable for corporate bonds. On the one hand, inflation is clearly ebbing, although the process could be longer in services. Interest rate cuts in 2024 may also extend over a longer period than anticipated by the market.

On the other hand, credit spreads have begun to contract with the intrinsic improvement in corporate credit quality – as demonstrated by the many agency rating upgrades observed recently. The default rates on high-yield bonds have dropped to historical lows and may rise gradually in the foreseeable future.

In this new interest rate and spread environment, we believe that longer-dated bonds are now more attractive for investors.

Bond picking – core to our investment process – will be a key success factor for this new fixed-term fund. The slowdown in growth is likely to impact the ratings of these companies. We shall therefore focus on higher quality ratings.

The high-yield bond market currently displays compelling technical characteristics. Indeed, the shrinking investment universe supports valuations, at a time when investors are clearly searching for yield. Furthermore, the dynamic primary market is likely to offer interesting investment opportunities.

Why choose Sycomore AM?

The same team of complementary and engaged experts, Stanislas de Bailliencourt and Emmanuel de Sinety, will manage the Sycoyield 2026 and 2030 strategies, with support from Tony Lebon, credit analyst. The team will leveragethe firm’s robust 12 years’ experience in proprietary credit analysis. The strategies investing in this asset class now have a combined total of 1.7 billion euros*** in assets under management.

Sycoyield 2030 is open for subscriptions, with no closing date or redemption fees. The fund, which aims to crystallise today’s attractive yields over the longer term, can play a key role within a diversified asset allocation thanks to its defensive profile (average BB rating).

*Data as of 29/02/2024.

**The fund managers are targeting these ratings at present. The situation can change at any time. The fund may hold bonds with all types of credit ratings.

***Data as of 29/02/2024.

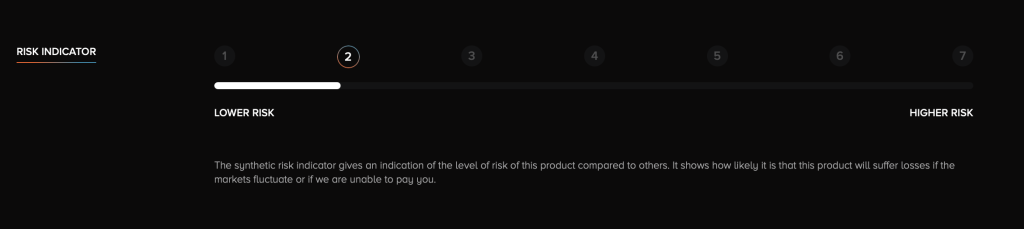

The fund offers no performance or yield guarantees and carries a risk of capital loss. The fund's objective is based on Sycomore AM's market assumptions and does not constitute a promise of fund performance. These assumptions include the risk of default or downgrading of one or more issuers in the portfolio. Should they materialize to a greater extent than anticipated, the management objective may not be achieved and the investor may suffer a capital loss. Opinions, estimates or forecasts regarding bond market trends or changes in issuers' risk profiles are based on current market conditions and are subject to change without notice. Sycomore AM makes no commitment that they will be achieved.